Protect Trust

Financial Services

Doppel doesn’t just protect financial institutions; we make them resilient. Our AI-powered platform neutralizes social engineering attacks at their source. The result? Your business becomes a fortress of trust, ready for anything.

Social engineering defense that makes your business too costly to target.

Stay well-guarded against online threats.

Unmatched Executive Defense

Empower Your Team

Results that speak for themselves

Our platform delivers measurable outcomes that transform how organizations approach brand protection and threat intelligence.

Traditional defenses can’t keep up with modern threats

The rise of AI has transformed social engineering attacks, making traditional defenses obsolete. Today's attackers use AI to scale sophisticated threats, creating entire ecosystems of deception with realistic personas, deepfakes and phishing across multiple surfaces at once

Legacy vendors can’t defend against multiple emerging channels

Multi-channel attacks need multi-channel protection

Connected intelligence delivers comprehensive protection

Safeguard your brand, leaders, and business from social engineering attacks with the most comprehensive social engineering defense platform.

Brand Protection

Protect your brand, preserve trust

Protect your digital brand by continuously detecting and disrupting impersonation and fraudulent activity across digital channels through unified intelligence and real-time monitoring, stopping threats before they escalate.

Executive Protection

Defend leadership, protect the business

Protect high-risk leaders from targeted social engineering, doxxing, impersonation, and deepfake attacks by continuously monitoring personal data exposure and threat activity across open and dark channels. Rapid mitigation and risk-based guidance reduce executive attack surface and response time.

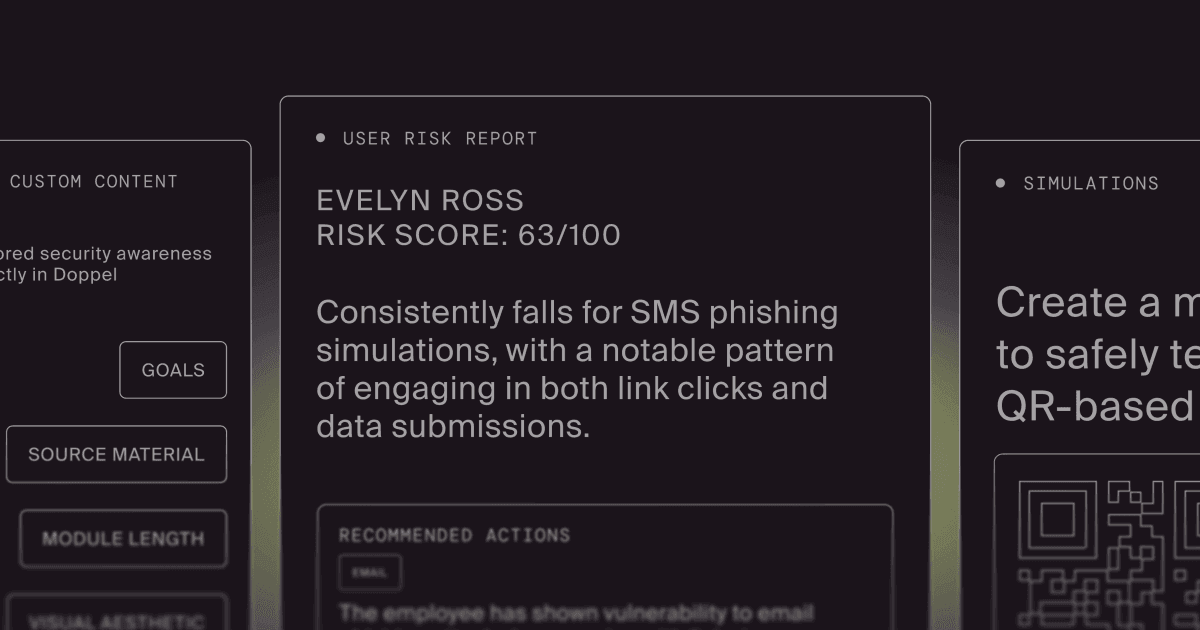

Simulation

Retire the phishing test, launch the simulation

Doppel Simulation delivers measurable business impact through realistic simulations and awareness training. Every scenario is designed to reveal real vulnerabilities, build response readiness, and feed directly into your defense strategy, turning training into tangible risk reduction.

Security Awareness Training

Train your teams. Build resilience.

Doppel Security Awareness Training strengthens employee defenses against the latest attacker tactics with tailored, deepfake-enabled, threat-informed training and personalized coaching. Every training is relevant, engaging, and designed to build resilience against modern security threats.

Make cybercrime too expensive.

We're not just another security vendor. We're redefining what's possible in threat intelligence and brand protection.

CFOs

CISOs

CEOs

Defending Digital Trust: SED Predictions for 2026

February 18, 2026 at 10:00 AM PST

By submitting this form, you agree to receive communications about our products and services

Real results from real customers

See how leading companies have transformed their security posture with Doppel.

Doppel achieved a 95% takedown success rate on Telegram fraud scams, reducing time-to-takedown from weeks (legacy providers) to 2–3 days. This preserved executive reputation, protected customers from fraud, and freed analysts from repetitive takedown requestsAnonymousGlobal Financial Sector Enterprise

Fresh perspectives, straight from our team

Stay ahead with the latest stories, industry insights, and behind-the-scenes updates

Frequently Asked Questions

Why is Doppel especially relevant for financial institutions?

Banks, insurers, and investment firms are top targets for phishing, fraud, and impersonation campaigns. Doppel’s platform dismantles the fraud enablement infrastructure behind cloned domains, scam ads, and social media impersonations — preventing account takeovers and financial loss before they occur

How does Doppel differ from legacy DRP vendors used in finance?

Competitors lack cross-surface coverage and modern automation. Doppel delivers graph-driven defense across domains, social, dark web, ads, and messaging apps, coupled with analyst-validated AI, making it more effective for large, complex financial institutions

How fast can Doppel take down phishing domains targeting customers?

Median phishing domain takedown is under one hour. This speed is critical in finance, where fraudulent login pages can drain accounts or damage trust if left online

How does Doppel support regulatory and compliance needs in finance?

The platform provides audit-ready dashboards logging takedowns, impersonation graph coverage, and response metrics. This helps financial services institutions prove to regulators, boards, and auditors that proactive measures are being taken to protect customers

Does Doppel scale for large, global enterprise financial organizations?

Yes. Doppel processes over 100M+ signals daily, scales across brands, regions, and executives, and integrates with SIEM/SOAR platforms (Splunk, Sentinel, Elastic, etc). Fortune 100 financial customers have cut remediation time from weeks to days while achieving >98% threat neutralization